Carraro: results for the third quarter of 2018

Carraro’s Board of Directors met October 26th, under the chairmanship of Enrico Carraro, to examine the Group’s results for the third quarter of 2018. «Even though there was a good performance in the main markets, especially Asia and North America, as at 30 September, profits were down, mainly due to the lack of efficiency in […]

Carraro’s Board of Directors met October 26th, under the chairmanship of Enrico Carraro, to examine the Group’s results for the third quarter of 2018.

«Even though there was a good performance in the main markets, especially Asia and North America, as at 30 September, profits were down, mainly due to the lack of efficiency in the supply chain and to the start-up of a new logistics hub that meant that some orders for spare parts were not filled,» said Enrico Carraro, Group Chairman. «On the basis of the good prospects for the upcoming year, we have accelerated investments in R&D while simultaneously expanding production capacity in our factories to make them more efficient in handling the new volumes we expect».

First target market for Carraro: agriculture

The third quarter of 2018 confirmed the slowdown in volume growth in Western Europe, with a reversal of trend compared to the same period of the previous year. After the record results posted in 2017 in Turkey, the figures for 2018 were sharply down. This was due to the serious instability in the country and the increase in vehicle prices due to the loss in value of the local currency.

Growth in the North American market was positive: net demand for agricultural equipment was up compared to the same period of 2017 for all vehicle sizes. India also continued with a positive trand, both for the internal and export markets. The expansion was also supported because of the decision by the Federal Government to increase the Minimum Support Price in view of elections scheduled for May 2019.

The downward trend continued instead in China, with some preference for machines over 100 HP. Finally, the economic situation in South America deteriorated sharply in 2018, with no change expected in the short term.

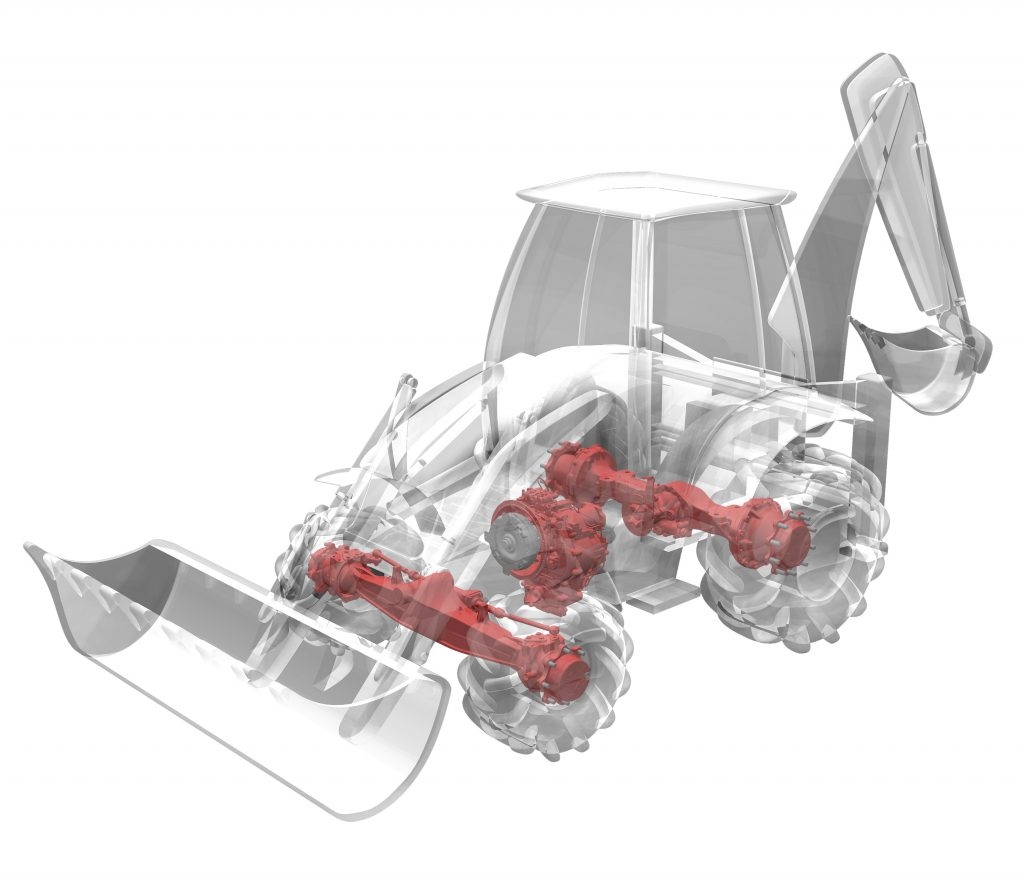

Second target market: construction and mining equipment

In Europe, the market favoured smaller specialised equipment rather than larger units. In Turkey, demand for construction equipment is worsening, with no prospects for a turnaround in the recession.

North America is enjoying a period of robust growth in the demand for utility equipment, with a sharp improvement over the same period of the previous year with forecastings for this trend to continue.

China registers a good progress in terms of sales volumes and the expansion in the Indian market was reinforced, driven by the planned investments in infrastructure.

In South America, the demand for construction equipment is still weak due to political and institutional instability.

Results as of 30 September 2018

Turnover of €467.9 million, up 3.8% from 2017, target markets overall confirmed prospects for an increase in volumes (especially for construction equipment), but profits did not reflect this trend because they were negatively influenced by a number of other factors, such as the failure of the supply chain to achieve the pre-established goals.

At the end of the quarter, the new exchange logistics hub in Poggiofiorito went into operation, immediately leading to an initial slowdown due to a number of strikes at the Monselice warehouse that limited operations and the transfer from one site to another.

CARRARO IBRIDO. TECHNOLOGY TO IMPROVE EFFICIENCY IN AGRICULTURAL FIELD

R&D programmes continued to accelerate compared to what was originally set out in the Plan. This allowed Carraro to present the first hybrid tractor in the world for vineyards and orchards during Eima fair in Bologna.

By the end of the year, a new prototype and testing area is set to be opened, as a project to expand the Carraro Campodarsego facility.

The Group’s activities are divided into two Business Areas: components in one hand, Carraro Drive Tech and Siap, tractors in the other hand, Carraro Agritalia.