Rolls-Royce stays fine despite COVID

Rolls-Royce Power Systems stays fine despite Covid-19. More than 3 billion euro revenue. During 2020 Rolls Royce acquired Kinolt, Servowatch and Qinous. Hydrogen is under the spotlight.

Rolls-Royce stays fine despite COVID. Or, at least, it was not damaged like other companies. Let’s discover the figures.

It’s not heaven, but we can say that Rolls-Royce stays fine despite COVID

According the company “Rolls Royce stays fine despite the COVID and it has ended the 2020 financial year with an underlying operating profit of £178 million (€200 million) (2019: £367 million, €418 million), despite suffering a 17% drop in underlying revenue to £2,745 million (€3,088 million) (2019: £3,184 million, €3,630 million). This corresponds to an underlying operating margin of 6.5% (2019: 11.5%). As a result, Power Systems, with its product and solutions brand mtu, remained well in the black during the 2020 pandemic year. Power Systems is taking advantage of the crisis to prepare for a shift in its business model towards integrated solutions for drive-power and energy needs in the post-COVID era – with special focus on sustainable, climate-friendly technologies. This is being aided by a reorganization featuring special business units for “Sustainable Power Solutions” and for China as well as investments in new technologies and site facilities.

«The COVID-19 crisis hit us hard, but we are still profitable, albeit not as profitable as in previous years. However, this is proof positive of the resilient nature of our business,» said Andreas Schell, CEO of Rolls-Royce Power Systems. Profit in the commercial marine segment was adversely affected by the pandemic-related collapse in tourism, among other factors. Shipyards closed down temporarily, hitting the yacht business, and economic uncertainty in many sectors of the economy led to a slowdown in capital investment and, in particular, shelving of plans to purchase power generation solutions. Public sector sales remained stable.

«The relatively good result for the year is largely down to a strict cost and liquidity management regime which we have applied throughout to mitigate the impact of the drop in revenue,» emphasized CFO Louise Öfverström. The company says it saw signs of an initial recovery in the second half of the year, however extensive lockdowns in many parts of the world since then continue to dampen customers’ willingness to invest. Öfverström continued: «We expect an improvement in order intake during the first half of 2021, converting into a recovery in sales from the second half of the year with revenues returning to approximately 2019 levels in 2022».

Kinolt, Servowatch and Qinous

Despite the financial challenges presented by COVID, Power Systems acquired three businesses last year in order to be able to ramp up activities as a solution provider to customers in a variety of markets. In 2020, Power Systems acquired Kinolt, a Belgian company making uninterruptible power supply systems using rotating flywheels, and Servowatch, a British ship automation manufacturer, as well as taking a majority stake in Qinous, now Power Systems’ microgrid competence center.

The companies are being integrated into the Power Systems division. «The Rolls-Royce Group enabled us to make these investments in our future in 2020 despite exceedingly difficult economic conditions. This illustrates the great confidence the Group has in us, particularly with regard to climate-friendly and environmentally friendly solutions,» continued Schell.

Hydrogen

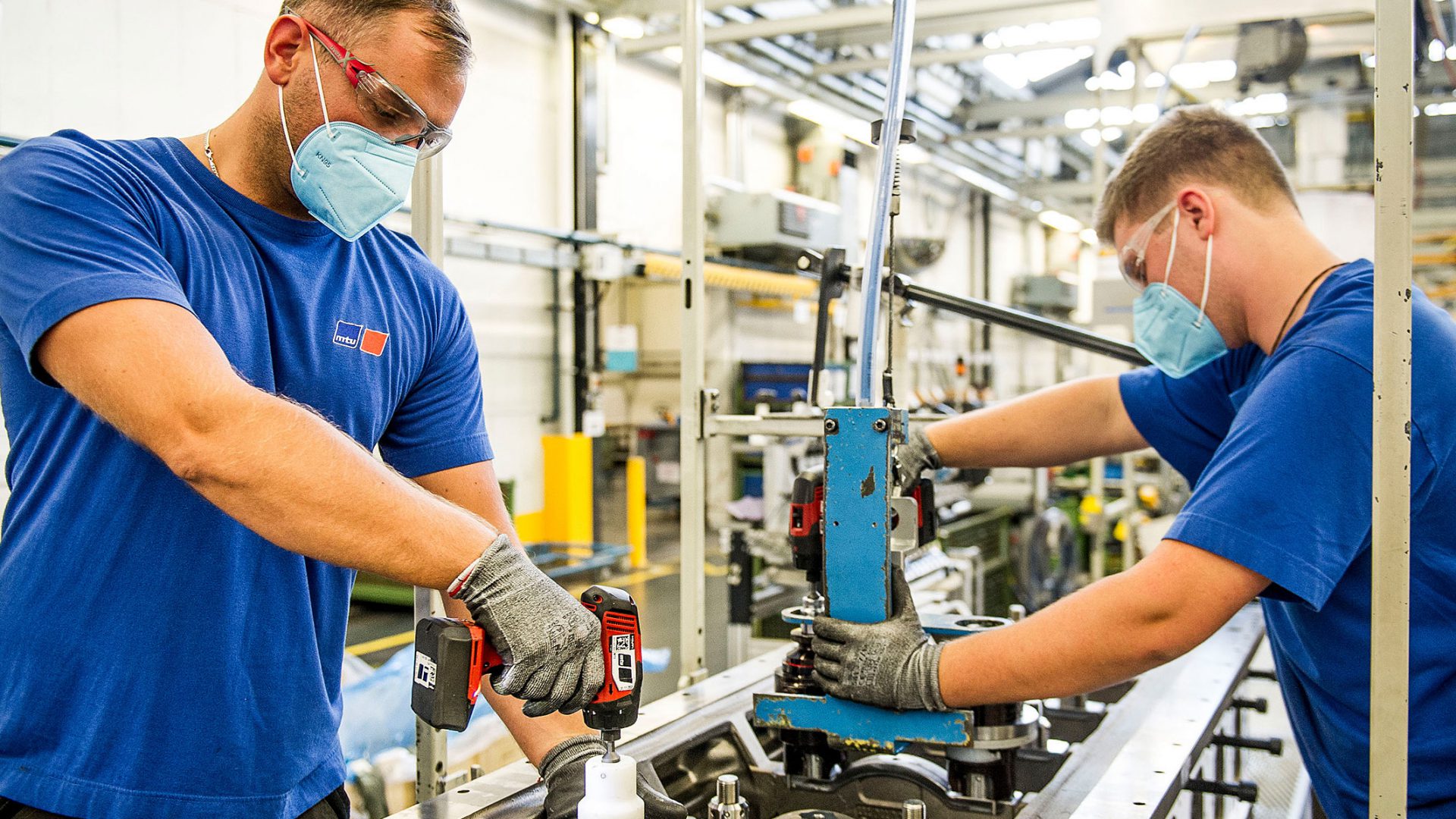

The company will be continuing down its transformation path in 2021 with selective investment in climate-friendly products, fully integrated solutions and existing site facilities, as well as continuing to drive the company’s established lines of business. “This year and last year, the larger-scale investments we made alone in extending our production sites up to a high double-digit-million amount. This is another way we are using the time of crisis to emerge stronger,” said Dr. Otto Preiss, member of the board for R&D and operations.

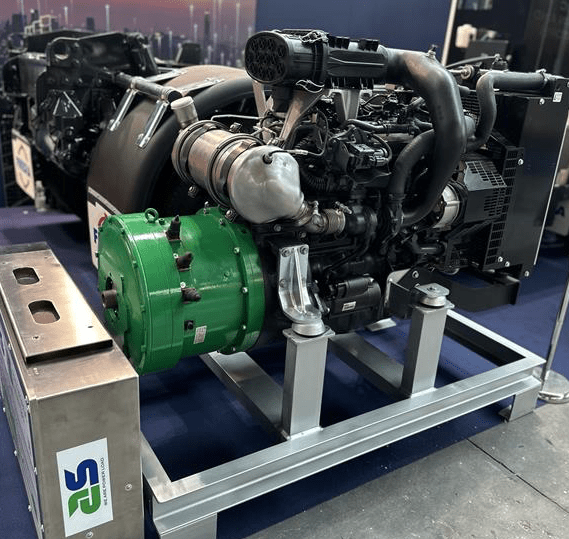

Production of the mtu EnergyPack battery storage containers is being expanded to over 50 containers per year at the company’s Ruhstorf facility in Lower Bavaria. In just twelve months, Power Systems has already made its mark on the market for renewable and smart energy solutions with interesting orders, for example in the South Pacific, Costa Rica, Australia and Norway.

«These major investments in our future are being funded by proceeds from today’s core business. It is the mainstay of our division, which is why we continue to invest heavily in it,» said Schell. The materials management center in Kluftern near Friedrichshafen will be expanded this year and next. Among other things, the Friedrichshafen assembly line for MTU Series 2000 engines is to be moved temporarily to the 10,000 sqm facility, which has already been approved, to allow refurbishment of the existing plant. Other major investments include a machining center for large engine housings, completion of the plant expansion in Mankato, and themicrogrid at the Aiken plant (both in the US), hydrogen infrastructure for the Friedrichshafen and Augsburg plants, and test stand refurbishments.

The fundamental strategic course of Power Systems division is also reflected in its reorganization, which will take effect on 31 March. «Our transformation to a solution provider requires us to be even closer to customers so that we can make it clear to them what benefits we can now offer them. After all, we’re already so much more than an engine maker,» Schell continued.

The Sustainable Power Solutions unit is of particular importance. It will manage closely all existing and future innovative solutions for more climate-friendly and more environmentally friendly drive power, propulsion and electrical power supplies. These will range from energy storage containers and fuel cells to the production and use of synthetic fuels. It will promote the use of new technologies for the green energy revolution across all areas of application and ensure that switching to new, climate-friendly solutions is as easy as possible for the company’s customers.

The task of a unit entitled ‘Power Solutions for Greater China‘ will be to continue to develop the growing markets in China. «We have been positioning ourselves increasingly well in China recently, and just at the end of the year we signed a sensational contract there for 1,000 engines. We want to become even more successful in this fast-growing market, but the Chinese market requires a special approach. That’s why we need an independent business unit there that can meet Chinese requirements specifically and individually,» said Schell, explaining this move.